State of the Art of Wealth Management Technology

|

DEC

06

|

|

||||||||||||||||||||||

Part 6 of 6 in our First Wednesdays: The Wealth Management Excellence Series.

A critical component in the evolution of Wealth Management is the contribution made by technological innovation. From more efficient practice management processes to improved client outcomes, tech solutions abound. But how does one separate the wheat from the chaff?

PANELISTS:

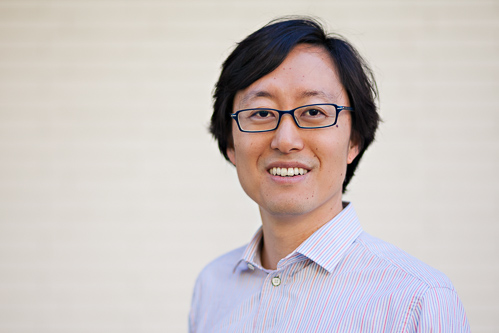

Edwin Choi, CFA | Edwin Choi is Co-Founder and CEO of Capitect, a provider of wealth management software that enables advisors to easily construct and implement personalized portfolios. Edwin is also the founder of Mariposa Capital Management, a boutique evidence-based wealth management firm in Los Angeles. Edwin is frequently quoted by the media for his thoughts and opinions on the direction of wealth management technology.

Edwin Choi, CFA | Edwin Choi is Co-Founder and CEO of Capitect, a provider of wealth management software that enables advisors to easily construct and implement personalized portfolios. Edwin is also the founder of Mariposa Capital Management, a boutique evidence-based wealth management firm in Los Angeles. Edwin is frequently quoted by the media for his thoughts and opinions on the direction of wealth management technology.

Prior to starting Mariposa, Edwin Choi was a structured credit derivatives trader with Merrill Lynch in New York. He was last a Director managing proprietary investments in index and bespoke tranches, CLOs, and for its short life, ABS correlation products.

Edwin holds a Master’s degree in Mathematics in Finance from NYU and a Bachelor’s degree with High Honors in Mechanical Engineering from UC Berkeley. He holds the Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP) designations. Back To Top ^^

Amy DeTolla | Amy DeTolla is a Senior Vice President at Focus Financial Partners, a leading partnership of independent, fiduciary wealth management and financial services firms, named for the sixth time as one of the nation’s fastest-growing private companies, according to Inc. magazine’s Inc. 5000 list. She advises elite wealth management teams and individuals as they transition their business to independence.

Amy DeTolla | Amy DeTolla is a Senior Vice President at Focus Financial Partners, a leading partnership of independent, fiduciary wealth management and financial services firms, named for the sixth time as one of the nation’s fastest-growing private companies, according to Inc. magazine’s Inc. 5000 list. She advises elite wealth management teams and individuals as they transition their business to independence.

Amy’s career spans over 20 years in financial services, specializing in advisor transitions, RIA efficiencies and financial technology solutions. Most recently, Amy was Managing Director of Client Services for a San Francisco Bay Area wealth advisory firm she helped launch. In this role, Amy spearheaded the firm’s technology stack implementation and led advisor and client transitions to the firm. As the head of the US Onboarding team for Blackrock, Amy was responsible for the creation of new ETFs, Hedge Funds and Institutional Client Strategies. Prior to Blackrock, she owned a consultancy whose focus was providing operational and technology solutions to RIAs. Earlier in her career, Amy was part of the management team that helped launch the Private Client Group at Robertson Stephens Investment Bank. Before Robertson Stephens, Amy was Senior Software Implementation Manager at Advent Software after she began her career at Fidelity Investments.

Amy lives in San Francisco, where she enjoys the skiing, surfing, mountain biking, backpacking and spending time at the beach with her husband. Back To Top ^^

Lori T. Hardwick | Lori Hardwick brings more than 25 years of experience of working in the financial industry as a prominent voice for financial services. As Founder & President of AI Labs, launched in 2017, Lori is leading the organization with her passion for providing impactful and innovative solutions to the advisory industry.

Lori T. Hardwick | Lori Hardwick brings more than 25 years of experience of working in the financial industry as a prominent voice for financial services. As Founder & President of AI Labs, launched in 2017, Lori is leading the organization with her passion for providing impactful and innovative solutions to the advisory industry.

Most recently, Lori served as Chief Operating Officer for Pershing, sharing leadership responsibility with the CEO for managing the Pershing family of companies.

Previously, Lori was Group President of Advisory Services for Envestnet, overseeing all of its enterprise relationship management, institutional and global advisory sales, and strategic partnerships. She had been with Envestnet since its founding in 2000.

In 2016, Lori was named to the “Women to Watch” list by InvestmentNews and also, made the 2016 Investment Advisor’s list of the 25 most influential people in the financial industry. Also, Lori was named one of the “50 Most Influential Women in Private Wealth” by Private Asset Management magazine in 2015 and one of the “50 Top Women in Wealth” by AdvisorOne in 2011. Lori currently serves on several boards including serving as a co-chair for the Executive Council for MMI’s Women in Wealth board. Back To Top ^^

MODERATOR:

Yves-Marc Courtines, CFA | Yves-Marc Courtines will serve as Moderator for this First Wednesdays: Wealth Management Excellence Series event on the State of the Art in WealthTech. In addition to serving as Chair of the 2017 series, Yves-Marc brings over 20 years of financial industry experience and curiosity to the moderator role. More importantly for a tech event, he is routinely called on for the wifi router password within home and business environments. Yves-Marc and the entire First Wednesdays Advisory Council hope to see you this December 6th and also encourage you to reserve your online spot for the 2018 series as well. Back To Top ^^

Yves-Marc Courtines, CFA | Yves-Marc Courtines will serve as Moderator for this First Wednesdays: Wealth Management Excellence Series event on the State of the Art in WealthTech. In addition to serving as Chair of the 2017 series, Yves-Marc brings over 20 years of financial industry experience and curiosity to the moderator role. More importantly for a tech event, he is routinely called on for the wifi router password within home and business environments. Yves-Marc and the entire First Wednesdays Advisory Council hope to see you this December 6th and also encourage you to reserve your online spot for the 2018 series as well. Back To Top ^^

A critical component in the evolution of Wealth Management is the contribution made by technological innovation. From more efficient practice management processes to improved client outcomes, tech solutions abound. But how does one separate the wheat from the chaff?

PANELISTS:

Edwin Choi, CFA | Edwin Choi is Co-Founder and CEO of Capitect, a provider of wealth management software that enables advisors to easily construct and implement personalized portfolios. Edwin is also the founder of Mariposa Capital Management, a boutique evidence-based wealth management firm in Los Angeles. Edwin is frequently quoted by the media for his thoughts and opinions on the direction of wealth management technology.

Edwin Choi, CFA | Edwin Choi is Co-Founder and CEO of Capitect, a provider of wealth management software that enables advisors to easily construct and implement personalized portfolios. Edwin is also the founder of Mariposa Capital Management, a boutique evidence-based wealth management firm in Los Angeles. Edwin is frequently quoted by the media for his thoughts and opinions on the direction of wealth management technology.Prior to starting Mariposa, Edwin Choi was a structured credit derivatives trader with Merrill Lynch in New York. He was last a Director managing proprietary investments in index and bespoke tranches, CLOs, and for its short life, ABS correlation products.

Edwin holds a Master’s degree in Mathematics in Finance from NYU and a Bachelor’s degree with High Honors in Mechanical Engineering from UC Berkeley. He holds the Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP) designations. Back To Top ^^

Amy DeTolla | Amy DeTolla is a Senior Vice President at Focus Financial Partners, a leading partnership of independent, fiduciary wealth management and financial services firms, named for the sixth time as one of the nation’s fastest-growing private companies, according to Inc. magazine’s Inc. 5000 list. She advises elite wealth management teams and individuals as they transition their business to independence.

Amy DeTolla | Amy DeTolla is a Senior Vice President at Focus Financial Partners, a leading partnership of independent, fiduciary wealth management and financial services firms, named for the sixth time as one of the nation’s fastest-growing private companies, according to Inc. magazine’s Inc. 5000 list. She advises elite wealth management teams and individuals as they transition their business to independence.Amy’s career spans over 20 years in financial services, specializing in advisor transitions, RIA efficiencies and financial technology solutions. Most recently, Amy was Managing Director of Client Services for a San Francisco Bay Area wealth advisory firm she helped launch. In this role, Amy spearheaded the firm’s technology stack implementation and led advisor and client transitions to the firm. As the head of the US Onboarding team for Blackrock, Amy was responsible for the creation of new ETFs, Hedge Funds and Institutional Client Strategies. Prior to Blackrock, she owned a consultancy whose focus was providing operational and technology solutions to RIAs. Earlier in her career, Amy was part of the management team that helped launch the Private Client Group at Robertson Stephens Investment Bank. Before Robertson Stephens, Amy was Senior Software Implementation Manager at Advent Software after she began her career at Fidelity Investments.

Amy lives in San Francisco, where she enjoys the skiing, surfing, mountain biking, backpacking and spending time at the beach with her husband. Back To Top ^^

Lori T. Hardwick | Lori Hardwick brings more than 25 years of experience of working in the financial industry as a prominent voice for financial services. As Founder & President of AI Labs, launched in 2017, Lori is leading the organization with her passion for providing impactful and innovative solutions to the advisory industry.

Lori T. Hardwick | Lori Hardwick brings more than 25 years of experience of working in the financial industry as a prominent voice for financial services. As Founder & President of AI Labs, launched in 2017, Lori is leading the organization with her passion for providing impactful and innovative solutions to the advisory industry.Most recently, Lori served as Chief Operating Officer for Pershing, sharing leadership responsibility with the CEO for managing the Pershing family of companies.

Previously, Lori was Group President of Advisory Services for Envestnet, overseeing all of its enterprise relationship management, institutional and global advisory sales, and strategic partnerships. She had been with Envestnet since its founding in 2000.

In 2016, Lori was named to the “Women to Watch” list by InvestmentNews and also, made the 2016 Investment Advisor’s list of the 25 most influential people in the financial industry. Also, Lori was named one of the “50 Most Influential Women in Private Wealth” by Private Asset Management magazine in 2015 and one of the “50 Top Women in Wealth” by AdvisorOne in 2011. Lori currently serves on several boards including serving as a co-chair for the Executive Council for MMI’s Women in Wealth board. Back To Top ^^

MODERATOR:

Yves-Marc Courtines, CFA | Yves-Marc Courtines will serve as Moderator for this First Wednesdays: Wealth Management Excellence Series event on the State of the Art in WealthTech. In addition to serving as Chair of the 2017 series, Yves-Marc brings over 20 years of financial industry experience and curiosity to the moderator role. More importantly for a tech event, he is routinely called on for the wifi router password within home and business environments. Yves-Marc and the entire First Wednesdays Advisory Council hope to see you this December 6th and also encourage you to reserve your online spot for the 2018 series as well. Back To Top ^^

Yves-Marc Courtines, CFA | Yves-Marc Courtines will serve as Moderator for this First Wednesdays: Wealth Management Excellence Series event on the State of the Art in WealthTech. In addition to serving as Chair of the 2017 series, Yves-Marc brings over 20 years of financial industry experience and curiosity to the moderator role. More importantly for a tech event, he is routinely called on for the wifi router password within home and business environments. Yves-Marc and the entire First Wednesdays Advisory Council hope to see you this December 6th and also encourage you to reserve your online spot for the 2018 series as well. Back To Top ^^

| Registration Fees $25 (Member) | $40 (Non-Member) |

|

REGISTER FOR THE 2018 WEALTH MANAGEMENT SERIES |

Parking Information

Millennium Biltmore Hotel Discounted Parking Rate: $24 Valet Parking

Additional Options:

Click links below for address and rates

Pershing Square Garage: Rates vary

Central Library Parking: Rates vary

Joe's Auto Parks: $12

Pacific Center Parking: $15

More Parking Options (Click link)

Millennium Biltmore Hotel Discounted Parking Rate: $24 Valet Parking

Additional Options:

Click links below for address and rates

Pershing Square Garage: Rates vary

Central Library Parking: Rates vary

Joe's Auto Parks: $12

Pacific Center Parking: $15

More Parking Options (Click link)

Payment Information

We accept the following:

If you prefer to pay by check please register online and select "purchase order" as your payment option and enter your last name as the purchase order number.

We accept the following:

If you prefer to pay by check please register online and select "purchase order" as your payment option and enter your last name as the purchase order number.

Mail check to:

CFA Society of Los Angeles, 520 S. Grand Ave, Suite 655, Los Angeles CA 90071.

*Credit card payments will only be accepted through the secure online registration, and not by phone or email.

Cancellations

Cancellations must be received in writing by 9:00 am the day prior to the event to receive a refund. No phone cancellations are accepted. Please fax to the CFALA office at (213) 613-1233 or e-mail info@cfala.org. Member “no-shows” will be billed the difference between the member fee and the non-member fee for the event which is posted on the CFALA website.

Cancellations must be received in writing by 9:00 am the day prior to the event to receive a refund. No phone cancellations are accepted. Please fax to the CFALA office at (213) 613-1233 or e-mail info@cfala.org. Member “no-shows” will be billed the difference between the member fee and the non-member fee for the event which is posted on the CFALA website.

Series Chairs:

Yves-Marc Courtines, CFA and Thomas Mahoney, CFA, CAIA

Yves-Marc Courtines, CFA and Thomas Mahoney, CFA, CAIA

| As a participant in the CFA Institute Approved-Provider Program, the CFA Society of Los Angeles has determined that this program qualifies for 1.5 credit hours. If you are a CFA Institute member, CE credit for your participation in this program will be automatically recorded in your CE Diary. |