CFALA 19th Annual Economic and Investments Forecast Dinner

|

FEB

2

|

|

||||||||||||||||||||||

MODERATOR

.jpg) Jane Wells | Jane is an award-winning broadcast journalist with over 30 years experience in the news media. She’s covered everything from earthquakes to riots, from the O.J. Simpson trials to Mother Teresa’s funeral, from the massacre at Columbine to the 2008 financial collapse. She has questioned CEOs about poor business decisions, posed as a prostitute for a story on AIDS, appeared in the “Seinfeld” finale, and even visited a group of professional cuddlers to see if the business was legit (it is). She is a Special Correspondent for CNBC, where she has worked for over 20 years. Jane also writes “Wells $treet,” a snarky take on the business world, for Meta’s Bulletin platform. Back To Top ^^

Jane Wells | Jane is an award-winning broadcast journalist with over 30 years experience in the news media. She’s covered everything from earthquakes to riots, from the O.J. Simpson trials to Mother Teresa’s funeral, from the massacre at Columbine to the 2008 financial collapse. She has questioned CEOs about poor business decisions, posed as a prostitute for a story on AIDS, appeared in the “Seinfeld” finale, and even visited a group of professional cuddlers to see if the business was legit (it is). She is a Special Correspondent for CNBC, where she has worked for over 20 years. Jane also writes “Wells $treet,” a snarky take on the business world, for Meta’s Bulletin platform. Back To Top ^^PANELISTS

Victoria L. Fernandez, CFA | Victoria joined Crossmark in July 2012 and serves as the Chief Market Strategist. She works with the firm's executive and research teams to analyze current market trends and provide comment to the media and public around Crossmark's investment outlook. She is also responsible for managing the Crossmark Fixed Income Investment team and Marketing division while serving as Portfolio Manager for taxable fixed income products.

Victoria L. Fernandez, CFA | Victoria joined Crossmark in July 2012 and serves as the Chief Market Strategist. She works with the firm's executive and research teams to analyze current market trends and provide comment to the media and public around Crossmark's investment outlook. She is also responsible for managing the Crossmark Fixed Income Investment team and Marketing division while serving as Portfolio Manager for taxable fixed income products.Victoria began her career in 1994 at Fayez Sarofim & Company, a Houston-based financial advisory firm. During her 18 years at the firm, Victoria enhanced her knowledge of the industry through a variety of roles within the fixed income division, including Head Trader, Municipal Portfolio Manager, and as an Associate on the management team.

Born and raised in Houston, Texas, Victoria remained in her hometown to earn her Bachelor of Arts from Rice University. She earned her MBA from the May's Business School at Texas A&M University and is a CFA® Charterholder.

As an active member of her community, Victoria has served on the boards of local non-profit organizations and religious institutions. In addition, she stays busy supporting her two children in their athletic and academic pursuits, along with volunteering in Literacy Strong, a local non-profit developed by her daughter to fight illiteracy. Victoria currently resides in Houston, and when not in the office, she enjoys walking her labradoodle and diving into a good book. Back To Top ^^

Jill Carey Hall, CFA | Jill is managing director and head of U.S. Small and Mid-Cap Strategy who joined BofA Global Research in 2009. As a senior U.S. Equity Strategist, she works closely with Savita Subramanian, in determining forecasts for the S&P 500, recommending sector allocations for U.S. equities and publishing thematic reports. Hall also authors a proprietary analysis of BofA equity client flow trends and leads the firm’s Global Research U.S. small and mid-cap strategy work.

Jill Carey Hall, CFA | Jill is managing director and head of U.S. Small and Mid-Cap Strategy who joined BofA Global Research in 2009. As a senior U.S. Equity Strategist, she works closely with Savita Subramanian, in determining forecasts for the S&P 500, recommending sector allocations for U.S. equities and publishing thematic reports. Hall also authors a proprietary analysis of BofA equity client flow trends and leads the firm’s Global Research U.S. small and mid-cap strategy work.Hall has been quoted in various financial news publications including the Wall Street Journal and Financial Times and is a frequent guest on CNBC and Bloomberg TV. She was named Bank of America’s 2016 “Rising Star” within Global Banking and Markets, an award given annually by the Women’s Bond Club to recognize aspiring leaders on Wall Street.

Hall has a bachelor’s degree in economics and business and a bachelor’s degree in English from Lafayette College. She is a CFA® Charterholder. Back To Top ^^

Michael Hasenstab, Ph.D | Michael is executive vice president and chief investment officer for Templeton Global Macro, which offers global, unconstrained fixed interest investment strategies through a variety of investment vehicles. Michael is a portfolio manager for a number of funds. He is also economic advisor to the CEO of Franklin Resources, Inc. and a member of Franklin Resources’ executive committee. Michael and his team have receive numerous industry awards and accolades through his investment career. The funds that he and his team manage have collectively received more than 400 awards. He has worked and traveled extensively abroad, with a special focus on Asia. Michael holds a Ph.D. in Economics and a master’s degree in Economics of Development, both from the Australian National University, and a B.A. in International Relations/Political Economy from Carleton College in the United States. Back To Top ^^

Michael Hasenstab, Ph.D | Michael is executive vice president and chief investment officer for Templeton Global Macro, which offers global, unconstrained fixed interest investment strategies through a variety of investment vehicles. Michael is a portfolio manager for a number of funds. He is also economic advisor to the CEO of Franklin Resources, Inc. and a member of Franklin Resources’ executive committee. Michael and his team have receive numerous industry awards and accolades through his investment career. The funds that he and his team manage have collectively received more than 400 awards. He has worked and traveled extensively abroad, with a special focus on Asia. Michael holds a Ph.D. in Economics and a master’s degree in Economics of Development, both from the Australian National University, and a B.A. in International Relations/Political Economy from Carleton College in the United States. Back To Top ^^ Jitania Kandhari | Jitania is Deputy CIO of the Solutions and Multi-Asset Group, Co-Lead Portfolio Manager for the Active International Allocation Strategy and Head of Macro and Thematic Research for the Emerging Markets Equity team at Morgan Stanley. She joined Morgan Stanley in 2006 and has 24 years of investment experience in global macroeconomics, country and market analytics, currencies and thematic investments. Recently Jitania was named in Citywire’s Top 20 female portfolio managers in the US for 2021. Prior to joining the firm, Jitania was an associate Vice President in private banking at ABN Amro (Royal Bank of Scotland). Jitania began her career in India at First Global Securities in Indian equities and then joined the securities brokering and investment banking at Kotak Securities in equity research and sales. She holds a Bachelor of Commerce degree in advanced financial and management accounting and an M.M.S. in finance, both from the University of Mumbai. Back To Top ^^

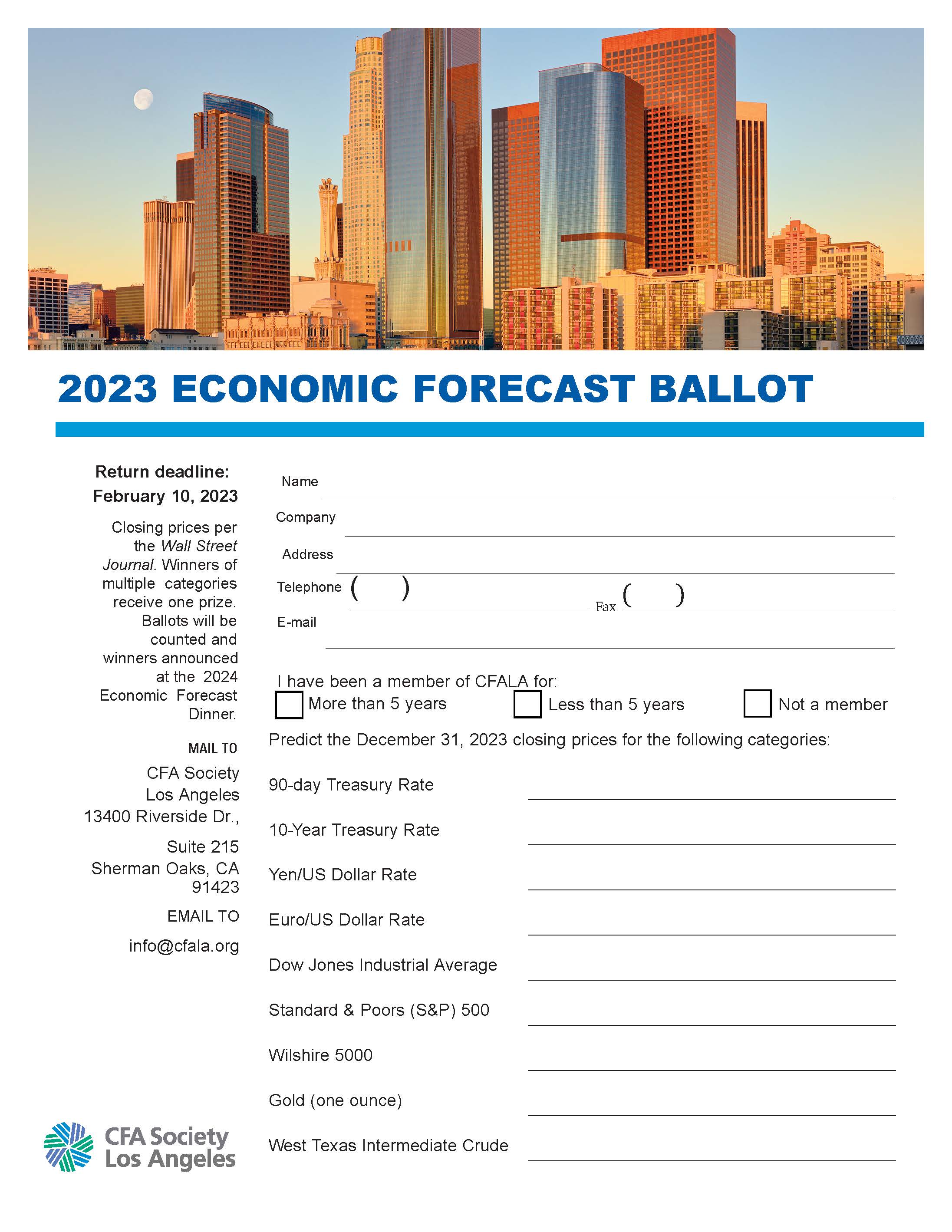

Jitania Kandhari | Jitania is Deputy CIO of the Solutions and Multi-Asset Group, Co-Lead Portfolio Manager for the Active International Allocation Strategy and Head of Macro and Thematic Research for the Emerging Markets Equity team at Morgan Stanley. She joined Morgan Stanley in 2006 and has 24 years of investment experience in global macroeconomics, country and market analytics, currencies and thematic investments. Recently Jitania was named in Citywire’s Top 20 female portfolio managers in the US for 2021. Prior to joining the firm, Jitania was an associate Vice President in private banking at ABN Amro (Royal Bank of Scotland). Jitania began her career in India at First Global Securities in Indian equities and then joined the securities brokering and investment banking at Kotak Securities in equity research and sales. She holds a Bachelor of Commerce degree in advanced financial and management accounting and an M.M.S. in finance, both from the University of Mumbai. Back To Top ^^ Please fill out your 2023 Economic Forecast Contest Ballot by February 10th, 2023 to have a chance to win a prize! The fillable PDF form contains instructions on how to mail and fax your ballot back to CFA Society Los Angeles, but you may also email your ballot back to us at info@cfala.org

Please fill out your 2023 Economic Forecast Contest Ballot by February 10th, 2023 to have a chance to win a prize! The fillable PDF form contains instructions on how to mail and fax your ballot back to CFA Society Los Angeles, but you may also email your ballot back to us at info@cfala.org|

Early Registration Fees (until January 3rd, 2023) Table Reservation Option *The only way to arrange for 8 individual seats together is through a Platinum, Gold, Silver, Bronze sponsorship opportunity or table purchase. Sponsorship Opportunities *Please note: This event will not be recorded* Registration is now CLOSED. Limited Walk-Ins Available. |

Non-Hosted Valet: $22

We accept the following:

If you prefer to pay by check please email info@cfala.org and request to pay by check. Your registration will be completed automatically and you will receive an email confirmation.

Mail Check To:

CFA Society of Los Angeles, 13400 Riverside Drive, Ste. 215 Sherman Oaks, CA 91423.

*Credit card payments will only be accepted through the secure online registration, and not by phone or email.

Table reservations are non-refundable. Other cancellations must be received in writing by 9:00 am the day prior to the event to receive a refund. No phone cancellations are accepted. Please e-mail info@cfala.org. Member “no-shows” will be billed the difference between the member fee and the non-member fee for the event which is posted on the CFALA website.

Tyler Furek, CFA

| As a participant in the CFA Institute Approved-Provider Program, the CFA Society of Los Angeles has determined that this program qualifies for 1.5 credit hours. If you are a CFA Institute member, CE credit for your participation in this program will be automatically recorded in your CE Diary. |

.png)