FinTech Presents: From Theory to Alpha - Quantitative Insights with Jason Hsu, PhD

|

SEP

18

|

|

||||||||||||||||||||||||||

A Fintech Advisory Council Sponsored Event

This September, the FinTech Advisory Council Presents From Theory to Alpha - Quantitative Insights with Jason Hsu, PhD—founder and CIO of Rayliant Global Advisors. We’ll explore Jason's journey from an award-winning academic researcher to building Rayliant into a global innovator in systematic asset management.

The conversation will explore Jason's investment philosophy, the growth of Rayliant, and the effects of AI and machine learning on financial markets. Jason will share his approach to challenging industry assumptions, as well as lessons learned from navigating market cycles and global shifts.

A dedicated segment will focus on practical advice for aspiring quant managers, essential technical skills, key mindsets, and strategies for career growth in a rapidly changing industry.

The session will conclude with an open Q&A, offering attendees the chance to engage directly with Jason and gain actionable insights on market trends, the future of asset management, and contemporary advances in quantitative FinTech.

This September, the FinTech Advisory Council Presents From Theory to Alpha - Quantitative Insights with Jason Hsu, PhD—founder and CIO of Rayliant Global Advisors. We’ll explore Jason's journey from an award-winning academic researcher to building Rayliant into a global innovator in systematic asset management.

The conversation will explore Jason's investment philosophy, the growth of Rayliant, and the effects of AI and machine learning on financial markets. Jason will share his approach to challenging industry assumptions, as well as lessons learned from navigating market cycles and global shifts.

A dedicated segment will focus on practical advice for aspiring quant managers, essential technical skills, key mindsets, and strategies for career growth in a rapidly changing industry.

The session will conclude with an open Q&A, offering attendees the chance to engage directly with Jason and gain actionable insights on market trends, the future of asset management, and contemporary advances in quantitative FinTech.

SPEAKERS

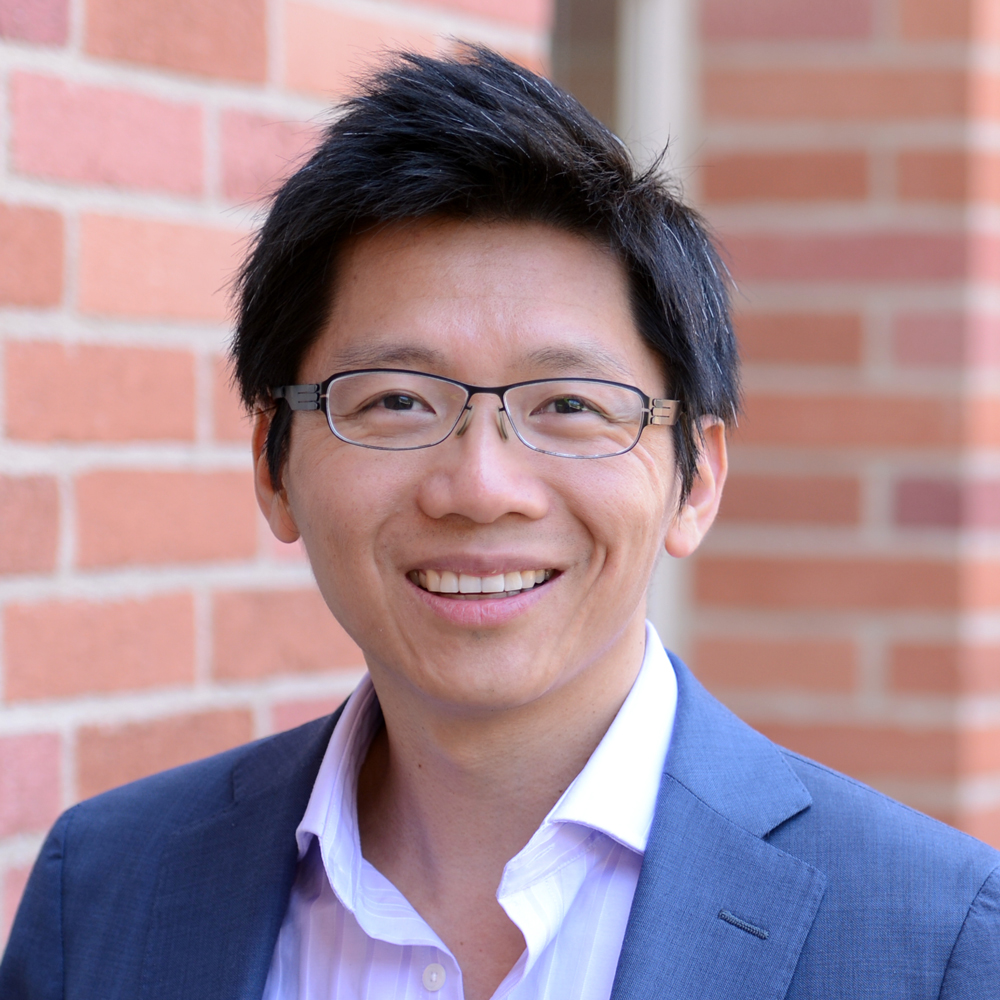

Jason Hsu, Ph.D | Jason Hsu is the founder and chairman of Rayliant Global Advisors. Throughout his accomplished career, Jason's commitment to academic rigor and investor advocacy has led him to research, develop, and bring to market investment strategies that create significant value for investors. At Rayliant, Jason is continuing that commitment by educating investors and offering products to transform the investment ecosystem in Asia and beyond. Prior to his current role, Jason was the co-founder and vice chairman of Research Affiliates.

Jason Hsu, Ph.D | Jason Hsu is the founder and chairman of Rayliant Global Advisors. Throughout his accomplished career, Jason's commitment to academic rigor and investor advocacy has led him to research, develop, and bring to market investment strategies that create significant value for investors. At Rayliant, Jason is continuing that commitment by educating investors and offering products to transform the investment ecosystem in Asia and beyond. Prior to his current role, Jason was the co-founder and vice chairman of Research Affiliates.Jason is at the forefront of the smart beta revolution and is one the world's most recognized thought leaders in that space. Building on his pioneering work on the RAFI™ Fundamental Index™ approach to investing with Rob Arnott in 2005, he has published numerous articles on the topic, notably his articles "A Survey of Alternative Equity Index Strategies," which won a 2011 Graham and Dodd Scroll Award and the Readers' Choice Award from CFA Institute; and "The Surprising Alpha from Malkiel's Monkey and Upside-Down Strategies," which won the 2013 Bernstein Fabozzi/Jacobs Levy Award for Outstanding Paper in the Journal of Portfolio Management. In 2015, Jason received the Bernstein Fabozzi/Jacobs Levy Outstanding Article Award for "A Study of Low-Volatility Portfolio Construction Methods" published in the Journal of Portfolio Management. He has twice received the William F. Sharpe Award for Best New Index Research (2005 and 2013), which is awarded by Institutional Investor Journals.

Jason is a member of the board of directors at the Anderson School of Management at UCLA, as well as a professor in finance. For his service to UCLA's Anderson School, he received the 2009 Outstanding Service Award. He has also held visiting professorships at Tsinghua University, Kyoto University and Taiwan National Chengchi University.

Jason has authored more than 40 peer-reviewed articles. He is an associate editor for Journal of Investment Management, and also serves on the editorial board for several publications including Journal of Index Investing, Journal of Investment Consulting, and Journal of Investment Management.

Jason graduated with a BS (summa cum laude) in physics from the California Institute of Technology, was awarded an MS in finance from Stanford University, and earned his Ph.D. in finance from UCLA, where he conducted research on the equity premium, business cycles, and portfolio allocations.

Back To Top ^^

MODERATOR

.png) Karyn Williams, Ph.D | Dr. Karyn Williams is the Regional Investment Manager (CIO), North America, Zurich Global Investment Management (ZGIM), responsible for all the invested assets and investment-related business initiatives, and a member of ZGIM and North America Finance leadership teams. Dr. Williams developed her expertise as investor, educator, trustee, independent public company director, treasurer, advisor, educator, and entrepreneur. Throughout her career, she has worked with nearly all types of investors, improving investment outcomes through education, governance, risk management, team building, and the application of advance analytics and financial technology. Her vision for change, education, and collaboration are hallmarks of her effectiveness as a leader in the field of investment management, where she continues to contribute through published articles and research, teaching and mentoring, and CFALA, trusteeship, and other industry leadership positions.

Karyn Williams, Ph.D | Dr. Karyn Williams is the Regional Investment Manager (CIO), North America, Zurich Global Investment Management (ZGIM), responsible for all the invested assets and investment-related business initiatives, and a member of ZGIM and North America Finance leadership teams. Dr. Williams developed her expertise as investor, educator, trustee, independent public company director, treasurer, advisor, educator, and entrepreneur. Throughout her career, she has worked with nearly all types of investors, improving investment outcomes through education, governance, risk management, team building, and the application of advance analytics and financial technology. Her vision for change, education, and collaboration are hallmarks of her effectiveness as a leader in the field of investment management, where she continues to contribute through published articles and research, teaching and mentoring, and CFALA, trusteeship, and other industry leadership positions.Back To Top ^^

|

Registration Fees |

Payment Information

We accept the following:

If you prefer to pay by check please email info@cfala.org and request to pay by check. Your registration will be completed manually and you will receive an email confirmation.

Mail Check To:

We accept the following:

If you prefer to pay by check please email info@cfala.org and request to pay by check. Your registration will be completed manually and you will receive an email confirmation.

Mail Check To:

CFA Society of Los Angeles

13400 Riverside Drive, Ste. 215

Sherman Oaks, CA 91423

*Credit card payments will only be accepted through the secure online registration, and not by phone or email.

Parking Information

Valet: $18

Valet: $18

Cancellations

Cancellations must be received in writing by 9:00 am the day prior to the event to receive a refund. No phone cancellations are accepted. Please e-mail info@cfala.org. Member “no-shows” will be billed the difference between the member fee and the non-member fee for the event which is posted on the CFALA website.

Cancellations must be received in writing by 9:00 am the day prior to the event to receive a refund. No phone cancellations are accepted. Please e-mail info@cfala.org. Member “no-shows” will be billed the difference between the member fee and the non-member fee for the event which is posted on the CFALA website.

Chair:

AJ Mildenberg, CFA

AJ Mildenberg, CFA

Event Chair:

Max Seeget, CFA

John Han, CFA

Max Seeget, CFA

John Han, CFA

.png) |

CFA Society Los Angeles has determined that this program qualifies for 1.5 PL credit hours, under the guidelines of the CFA Institute Professional Learning program. If you are a CFA Institute member and a CFA Society Los Angeles Member, PL credit for your participation in this program will be automatically recorded in your PL tracking tool. |